By Hans Detlefsen

Hotel Appraisers & Advisors (HA&A) is pleased to announce our third annual ranking of hotel real estate investment trusts (REITs). HA&A currently monitors 16 hotel REITs, discussed throughout this report. Some hotel REITs are more effective than others at generating earnings and passing profits on to investors. In this year’s report, we rank each of these hotel REITs according to three metrics: (1) dividend yields; (2) profit margins; and (3) overhead expenses. Our 2018 rankings are based on year-end 2017 data from each of the 16 hotel REIT companies we monitor.

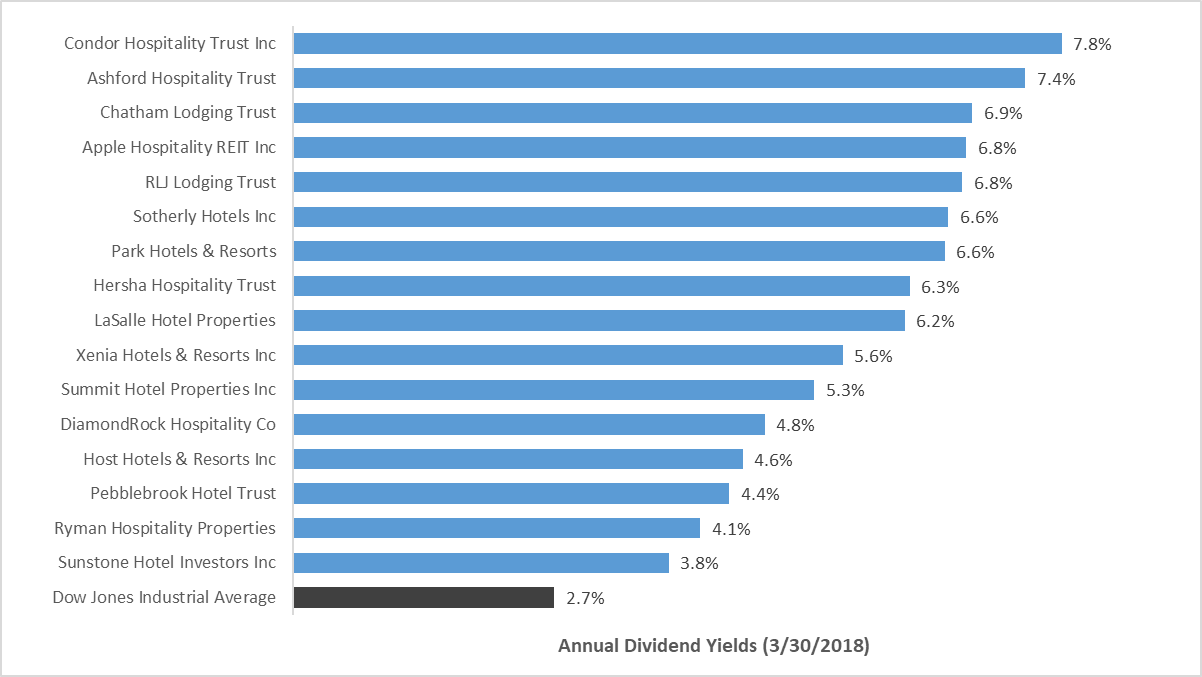

Hotel REITs offer some of the highest dividend yields in the stock market. Their current dividend payments represent yields in the range of 3.8 percent to 7.8 percent. By comparison, the average dividend yield of all stocks in the Dow Jones Industrial Average is currently 2.7 percent.

The following figure illustrates how each of the 16 hotel REIT companies we track ranks according to annual dividend yield estimates.[1]

Figure 1 – Hotel REITs Ranked by Annual Dividend Yields

Condor Hospitality (CDOR) and Ashford Hospitality Trust (AHT) offer the highest dividend yields in our study, with recent dividend yields of about 7.8 percent and 7.4 percent, respectively. Chatham Lodging Trust (CLDT), Apple Hospitality REIT (APLE), RLJ Lodging Trust (RLJ), Sotherly Hotels (SOHO), and Park Hotels & Resorts (PK) all offer current dividend yields above 6.5 percent. Everything else being equal, one would expect REITs with higher dividend yields to have higher earning potential relative to their stock prices and market capitalizations. Additionally, one might expect REITs offering lower dividend yields to produce higher capital gains. But everything else is not always equal[2], which leads to our next topic.

Some hotel REITs invest in newer, select-service hotels, with lean labor models and high profit margins. Other hotel REITs invest in urban trophy assets or irreplaceable resort hotels. Some hotel REITs invest in a mix of full-service and limited-service hotels. Yet others concentrate on hotels in certain geographical areas. The types of hotels each REIT acquires can greatly influence the overall profit margin achieved by its hotel portfolio.

So, the second metric we track is profitability. Specifically, we analyze the overall profit margins of each REIT’s hotel portfolio. We calculate this metric by isolating each REIT’s hotel-generated earnings before interest, taxes, depreciation, and amortization (EBITDA), a common earnings metric in the industry. We then express these earnings as a percentage of hotel operating revenues derived from the hotels owned by each REIT. We apply a standardized reserve for replacement expense to each REIT’s portfolio, equivalent to 4.0 percent of annual hotel operating revenues, when calculating the hotel EBITDA amounts. The resulting profitability ratio is a simple metric that allows us to measure how profitable the hotels are within each REIT’s portfolio. This metric helps investors understand how efficient each REIT’s hotels are at converting revenues into profits.

The following figure illustrates that hotel REITs exhibit a wide range of profitability from their respective hotel portfolios. The figure shows hotel earnings ratios that range from 22.6 percent to 36.3 percent of total hotel operating revenues.

Figure 2 – Hotel REITs Ranked by Earnings Margins

Three of the REITs we monitor achieved aggregated earnings of more than 30.0 percent across their entire hotel portfolios. These three REITs – Chatham Lodging Trust (CLDT), Apple Hospitality REIT Inc. (APLE), and Summit Hotel Properties, Inc. (INN) – all focus on select-service hotels, primarily in the upscale chain scale. Most of the REITs that have lower earnings ratios focus on full-service hotels in the upper-upscale and luxury chain scales.

In general, limited-service and select-service hotels operate more efficiently than full-service hotels and luxury resorts. Full-service hotels generally have lower profit margins than select-service hotels because many of the operating departments offered at full-service hotels are not as profitable as the rooms department, which is the primary source of revenue for select-service hotels. Newer hotels and hotels in high-rated markets also tend to produce higher profit margins than older hotels or hotels in lower-rated markets. So, it is not surprising that the three REITs that scored best on this profitability metric for 2017 have portfolios primarily containing limited-service and select-service hotels, mainly located in high-rated destinations or urban markets.

The third metric we track is intended to measure how efficiently each REIT passes along hotel earnings to its investors. It is a measure of how expensive it is for each REIT to manage and administer its hotel portfolio. Investors in hotel REITs have at least two types of fees that must be paid to managers and administrators.

The first type of fees we monitor are hotel management fees. REITs hire professional hotel management companies[3] to oversee the day-to-day operations of each hotel they own. In addition to paying for labor and other operating expenses at the hotels, the REITs must pay a professional fee to each of these companies they retain to manage property-level hiring, training, reporting, and other management duties. These expenses are called hotel management fees.

The second type of fees we monitor are corporate expenses. Each REIT’s internal staff has responsibilities for implementing an investment strategy, asset management, and other corporate and administrative tasks, all of which represent expenses to shareholders. These expenses are typically called corporate general and administrative expenses, or something similar.

Together, the sum of the hotel management fees and the REITs’ corporate general and administrative expenses represent a rough gauge of how much it costs investors to extract earnings from each REIT’s hotel portfolio. For comparison purposes, we sum each REIT’s 2017 base management fees, incentive management fees, and corporate overhead expenses, including corporate general and administrative expenses as well as advisory service fees.[4] We then compare these expenses to each REIT’s 2017 hotel earnings (before management fees are deducted) to determine overhead expense ratios.

The next figure illustrates a wide range of performance among the REITs on this overhead expense metric. In this figure, a lower ranking is better.

Figure 3 – Hotel REITs Ranked by Overhead Expense Ratios

For every dollar of earnings generated by the hotels in each REIT’s portfolio, somewhere between 15.2 cents and 47.3 cents were spent on hotel management and corporate overhead in 2017.

Apple Hospitality REIT Inc. (APLE) offers the leanest overhead and management structure. With more than 30,000 hotel guestrooms in its portfolio, APLE’s size is a contributing factor to its cost effectiveness. In 2017, for example, APLE spent only $869 per guestroom on corporate general and administrative expenses, compared to an average of $2,065 per guestroom for the 16 hotel REIT companies we monitor.

LaSalle Hotel Properties (LHO), Ryman Hospitality Properties (RHP), Sunstone Hotel Investors Inc. (SHO), DiamondRock Hospitality Company (DRH), Pebblebrook Hotel Trust (PEB), Chatham Lodging Trust (CLDT), and RLJ Lodging Trust (RLJ) all exhibited overhead expense ratios below 20.0 percent of their earnings in 2017.

Condor Hospitality Trust Inc. (CDOR) had the highest corporate and management expense ratio in 2017. This is partly because CDOR was still executing a major strategy transition in 2017, shifting its asset allocation away from economy hotels and towards upper-midscale and upscale, select-service hotels. As this transformation continues, the company’s expense ratio may decline significantly.

The figures discussed throughout this article can vary from year to year. However, all else equal, investors may generally prefer to gain exposure to hotel portfolios with higher operating profit margins and lower management and corporate overhead expenses. Some investors may also be attracted to certain hotel REIT stocks due to the relatively high dividend yields they pay. This report is intended for discussion purposes only and is not intended to be construed as investment advice. If you would like to source this article, please contact the author for permission.

[1] Calculated based on most recent annualized dividend announcements and closing stock prices, as of March 30, 2018. [2] Some REITs are better than others at producing profits and passing them on to investors. See Figures 2 and 3. [3] While REITs are not allowed to manage their own hotel properties, some of the REITs we track have officers who own shares in the third-party management companies the REITs employ to manage their hotels. [4] For the purpose of this article, we collectively refer to these expenses as “overhead” expenses.