Domestic leisure to sustain travel growth in coming months; All other sectors expected to slow further into early 2017

WASHINGTON (December 6, 2016)—Despite some strength in domestic leisure travel, U.S. travel growth eased overall in October 2016, according to the U.S. Travel Association's Travel Trends Index (TTI), beginning a predicted slowdown into the first months of 2017.

Due to a variety of factors, both international inbound travel and domestic business travel demand weakened in October, as projected by previous TTI reports, and will continue to do so in the coming months. After outperforming domestic leisure travel in September, international travel slowed in October, weighed down by a stubbornly strong U.S. dollar. The TTI's Leading Travel Index predicts that international travel will continue to decelerate. Domestic business travel also resumed its pattern of decline, after briefly outpacing domestic leisure travel in September.

Domestic leisure travel will remain the primary driver of U.S. travel growth into the first few months of 2017.

"Given the expected stagnation in both international inbound and domestic business travel, continued growth in domestic leisure travel will remain the key to fueling the U.S. travel industry in the months ahead," said David Huether, U.S. Travel Association senior vice president for research. "The relative strength of domestic leisure travel will likely be further highlighted as holiday travel numbers are reflected in the coming months' readings.

"As we head into the holiday season, it's worth remembering that according to multiple research studies, taking time off to travel and spend time with family and friends improves Americans' health and productivity. As an added bonus, domestic leisure travel significantly benefits the U.S. economy as well."

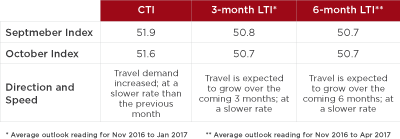

In the full TTI report, the 3- and 6-month LTI reading of 50.7 indicates that U.S. travel volume is expected to grow at a rate of around 1.4 percent through April 2017.

The TTI consists of the Current Travel Index (CTI), which measures the number of person-trips involving hotel stays and/or flights each month, and the Leading Travel Index (LTI), which measures the likely average pace and direction of business and leisure travel, both domestic and international inbound. It assigns a numeric score to every travel segment it examines—domestic and international, leisure and business—in current, 3-month and 6-month predictive indicators. As with many indices similarly measuring industry performance, a score above 50 indicates growth, and a score below 50 indicates contraction.

The U.S. Travel Association developed the TTI in partnership with Oxford Economics, and draws from multiple data sources to develop these monthly readings. In order to compile both the CTI and LTI readings, the organization's research team utilizes multiple unique non-personally identifiable data sets, including:

- Advance search and bookings data from ADARA and nSight;

- Passenger enplanement data from Airlines for America (A4A);

- Airline bookings data from the Airlines Reporting Corporation (ARC); and

- Hotel room demand data from STR.

Learn more about the Travel Trends Index.

Click here to read the full report.