Go With the Flow

An Analysis of Flow Multiples Measuring Revenue Retained as Profits

|

News for the Hospitality Executive |

Go With the Flow

|

By Gary McDade and Robert

Mandelbaum

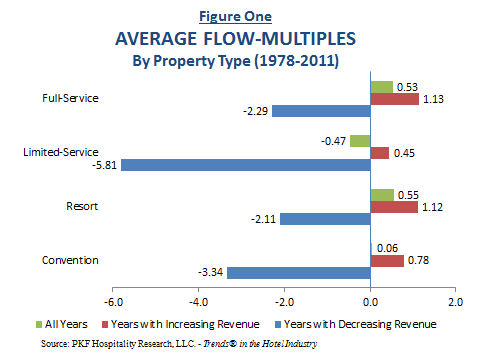

April 17, 2013 The U.S. lodging industry recovery made great progress in 2011 with over 70 percent of the hotels in the nation showing increases in both revenue and profits during the year. Many industry prognosticators, including PKF Hospitality Research, LLC (PKF-HR), are expecting this trend to continue in the future. Based on the PKF-HR’s December 2012 Hotel Horizons® forecast, U.S. hotels will enjoy compound annual growth (CAGR) in rooms revenue (RevPAR) of 6.5 percent through 2016. In turn, this should result in a CAGR of 6.1 percent in total hotel revenue during the same period. Given these strong projections of revenue growth, how much profit can hoteliers expect to earn in the coming years? To understand how these increased revenues will flow to the bottom line, PKF-HR evaluated the financial performance of hotels for the period 1978 through 2011. The information came from data published in PKF-HR’s Trends® in the Hotel Industry reports for that period. During our analysis, we measured the relationship between annual changes in total hotel revenue and movements in net operating income (NOI) for four different property types: full-service, limited-service, resort and convention hotels. For this analysis, NOI is defined as income before deductions for capital reserve, rent, interest, income taxes, depreciation, and amortization. Calculating Flow For each property type we calculated a “flow-multiple” that measures how much an increase (or decrease) in revenue was retained as profits. Simply put, the flow-multiple is the ratio of year-to-year changes in profit to changes in revenue, and therefore, provides evidence of how well properties manage expenses and maximize profits. During our research, we discovered that the flow-multiples varied greatly between recessionary periods and times of prosperity. Therefore, we chose to analyze these two situations separately using different flow-multiple calculation equations:

Convention hotel profits also exhibited a high degree of sensitivity to decreases in revenue. Over the entire period of analysis, the average flow-multiple for these properties was negative 3.34 (-3.34) during years when revenue declined. However, it should be noted that greatest levels of negative flow-multiples occurred during the 1980s. In recent years, convention hotels have been able to achieve more efficient flow-multiples during periods of both revenue growth and decline. Future Flow According to PKF-HR’s December 2012 Hotel Horizons® forecast, hotels in the luxury, upper-upscale, and upscale chain-scales exceeded their long-run average occupancy levels in 2011. Therefore, RevPAR gains for properties in these categories are already being influence by ADR growth. As we know from previous research, RevPAR growth driven by ADR contributes to high flow-multiples. Based on this trend, and historically high flow-multiples, the profit outlook for full-service, resort, and convention hotels is extremely bright. Significant profit flow for limited-service hotels, on the other hand, will be delayed by a year or two. The recovery for hotels in the upper-midscale, midscale, and economy segments has lagged the upper-tier properties. Therefore, ADR influenced RevPAR gains for these mostly limited-service properties will not occur until 2013 or 2014. Lagging ADR growth, combined with historically low flow-multiples, implies that profits for limited-service hotels will grow, albeit at a slower pace compared to the full-service properties.  Robert Mandelbaum is Director of Research Information Services for PKF Hospitality Research, LLC (www.pkfc.com). Gary McDade is a Research Analyst. Both work in the firm's Atlanta office. To purchase a copy of Trends® in the Hotel Industry and benchmark the flow-multiples of your hotels, please visit www.pkfc.com/store. This article appeared in the March 2013 issue of Lodging. |

| Contact:

Robert Mandelbaum |