|

|

|

|

|

|

,

|

Managers and Meeting Planners What's in the Minds of Meeting Planners Today? |

| by Robert Mandelbaum, January 2004

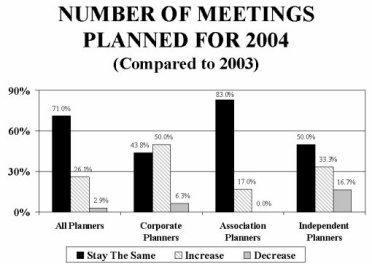

One of the most intriguing changes in the hotel industry during the past two years has been the relationship between hotel sales managers and meeting planners. During most of the 1990s, hotel sales managers were able to wield almost uncanny power in negotiating with meeting planners for space, room rates, and contract clauses. However, that all changed in 2001, when occupancies plunged and the shoe shifted to the other foot as hotel sales people aggressively sought and pursued any meeting planner they thought capable of delivering business to their hotel. Unfortunately, for the meeting planners, budgets were cut, attendance at their events declined, and some events were even canceled. Meetings demand declined from 25.9 percent of total room nights for our Trends in the Hotel Industry survey sample in 2000, to 21.6 percent in 2002. Working under such severe conditions, meeting planners were unable to fully exercise their newly found negotiating power. Now that most prognosticators, including PKF Consulting, are forecasting a recovery in hotel performance during the next few years, the question becomes how will the relationship between hotel sales managers and meeting planners evolve? From the hoteliers� perspective, sales managers are eager once again to book lots of group room nights and drive up room rates. The unknown for hoteliers is what will the meeting planners be able to bring to the table? How will the game be played, now that the economy seems to be recovering? On behalf of ConventionSouth Magazine, PKF Consulting surveyed the expectations of meeting planners with 69 different organizations. While the survey focused on meetings planned in the southern region of the U.S., the sample of planners was national is scope. The sample was divided into three categories: corporate planners, association planners, and independent planners. The following paragraphs highlight some findings of the survey and sheds light into the mindset of meeting planners regarding their use of hotels over the next few years. Number of Meetings The tide seems to have turned. The annual declines in meetings that began in 2001 and continued through mid-2003 have finally bottomed-out. The vast majority (71 percent) of the meeting planners surveyed stated that the number of meetings they are planning for 2004 is the same as the number of meetings that will be held in 2003. Of note is that only 2.9 percent of the planners believed they would be planning fewer meetings in 2004 than in 2003. In looking toward 2004, corporate planners showed a more optimistic

outlook than association planners. Half of the corporate planners

surveyed believed they would be planning more meetings in 2004 than in

2003. Hotels can only hope that this promised increase in corporate

group travel will be matched by an increase in individual corporate travel.

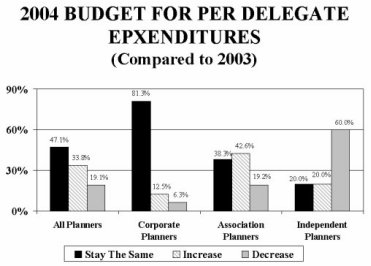

Meeting Budgets In addition to planning the same number of meetings in 2004, most meeting planners will be working with budgets similar to what they had in 2003. Of the meeting planners surveyed, 47.1 percent stated that their budgets for conducting meetings would remain flat from 2003 to 2004. A thankful group of planners (33.8 percent) have been given an increase in their meetings budget for 2004, while 19.1 percent have had their budgets cut. While corporate planners expect to conduct more meetings in 2004, association

planners appear to have more dollars to work with to plan their meetings.

A preponderance (42.6 percent) of association meeting planners has larger

meetings budgets for 2004 than they had in 2003. On the other hand,

budgets of 81.3 percent of the corporate planners have been frozen for

next year.

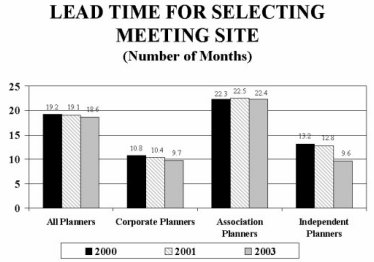

Site Selection Lead-Time Since 2001, hoteliers contend that lead times for the group booking process have grown shorter. Hotel sales managers have been reporting that meeting planners are �walking in the door� to plan meetings, allowing only a few months lead-time. While our survey does confirm a shortening of the site selection process, the reality is that the magnitude of the decline is not that great. Moreover, the trend differs between corporate and association planners. Overall, the number of months before the event that meeting planners

wait before selecting their site has declined from 19.2 months in 2001

to 18.6 months in 2003. This overall downward trend is comparable

to the pattern observed for corporate planners (10.8 months in 2001 compared

to 9.7 months in 2003). However, association planners have actually

increased the number of months they take to select a site - from 22.3 months

in 2001 to 22.4 months in 2003. The shortening of the site-selection

lead-time for corporate meetings reflects the severe financial restraints

that corporate planners are working within, as well as the day-to-day decisions

businesses are making regarding whether or not to hold meetings in the

first place.

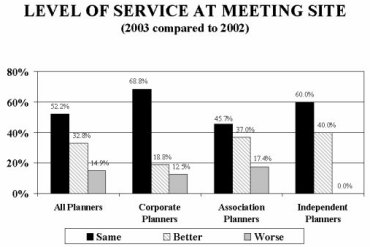

Level Of Service While corporations and associations may have held fewer meetings in recent years, they are no less concerned about the quality of service they receive at the meeting site. A slight majority of the planners surveyed (52.2 percent) stated that the level of service they received at their meeting sites in 2003 was the same as that delivered in 2002. On a positive note, 32.8 percent perceived service levels to have improved in 2003, while only 14.9 percent felt service had deteriorated. Association planners were somewhat more pleased with the service they

received in 2003, compared to 2002. More association planners (37.0

percent) believe service improved in 2003, as opposed to just 18.8 percent

of the corporate planners. Again, the majority of both types of planners

felt service levels have remained the same.

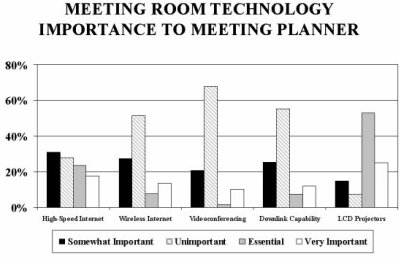

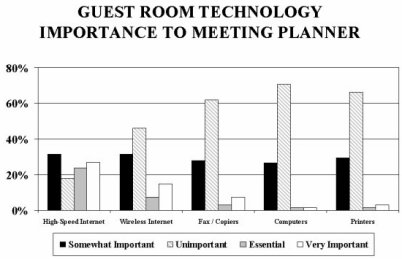

Guest Room Technology Consistent with the quick and frequent changes within high-tech industry, technology vendors have constantly approached hotel owners and operators during the past few years to offer the �latest and greatest� communication, entertainment, and business services for guest use. The ever-changing variety of technology services has bewildered most hoteliers. Hotels know they need to offer guests the latest technology, but have to justify the investment during these tough economic times. In order to assist hoteliers in making this evaluation, our survey asked meeting planners to rank the importance of select guest room and meeting room technologies in their site selection process. The technology receiving the highest rating of importance in the site selection process was high-speed Internet connectivity. Meeting planners believed that high-speed Internet connectivity was either �very important� or �essential� for both guest rooms and meeting rooms. The only other technology receiving a high importance rating was the need for meeting rooms to have LCD projectors. Videoconferencing, long feared to be the ruin of meetings business for hotels, was rated by 67.7 percent of the planners as being an �unimportant� meeting room feature. Other meeting room technologies rated as being �unimportant� to the majority of planners surveyed include wireless Internet connectivity and downlink capability. In the guest rooms, only high-speed Internet connectivity was believed

to be �very important� or �essential�. In-room wireless Internet

connectivity, fax machines, copiers, computers, and printers were all believed

to be �unimportant� by the majority of meeting planners surveyed.

. Based on the responses to our survey, hotel sales managers can take

comfort in the fact that the meeting industry downturn does appear to be

stabilizing. Planners are, for the most part, conducting the same

number of meetings and retaining their budgets. While remaining �flat�

is not the most desired measure of success, any performance measurement

without a negative sign in front of it is welcome news.

---. Charts at < chartsforlodging> |

| Contact:

Robert Mandelbaum Director of Research Information Services The Hospitality Research Group of PKF Consulting 3340 Peachtree Road, Suite 580 Atlanta, GA 30326 Phone: (404) 842-1150, ext 223 E-Mail: [email protected] www.hrgonline.com |

| Also See: | Bed-and-Breakfast and Country Inns Suffer Less than Hotels / Robert Mandelbaum / December 2003 |

| PKF Consulting Forecasts 2003 Holiday Season for Hotels; 2003 Performance Will Exceed Levels Achieved in the Year 2000 / PKF / November 2003 | |

| 2003 First Half Hotel Profits Plunge; Average U.S. Hotel Suffered 11.9% Decline in IBFC During the First Six months of 2003 / PKF / October 2003 | |

| Operating Profits for the Average U.S. Hotel Dropped 9.6% in 2002, This After a 19.4% Decline In 2001 / PKF Consulting - HRG Annual Hotel Trends Report / April 2003 | |

| Hotel Benchmarking Revisited; Bottom-Line Comparisons Among Similar Properties Are the 'Bottom Line' / May 2003 |