|

|

|

|

|

|

|

Ernst & Young LLP |

Top Ten Thoughts

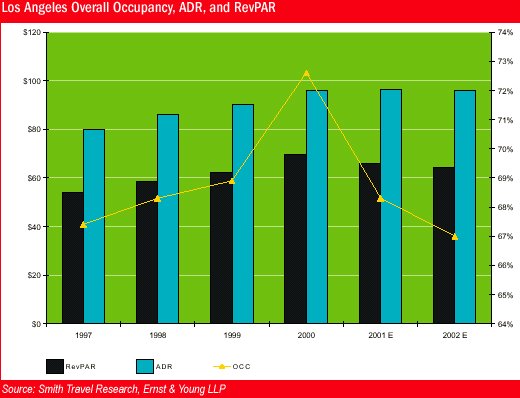

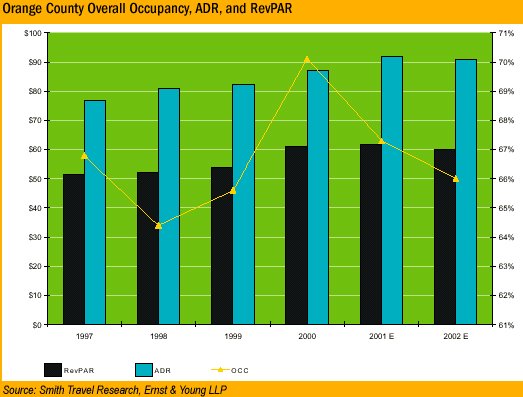

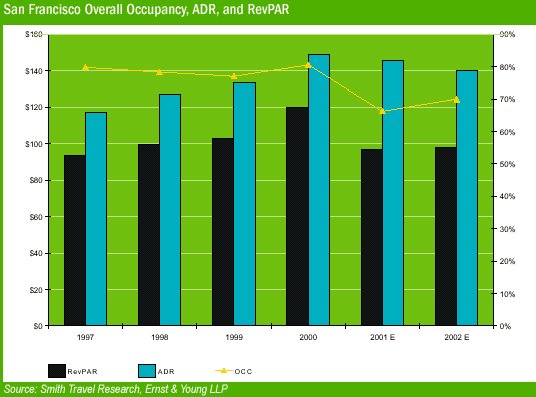

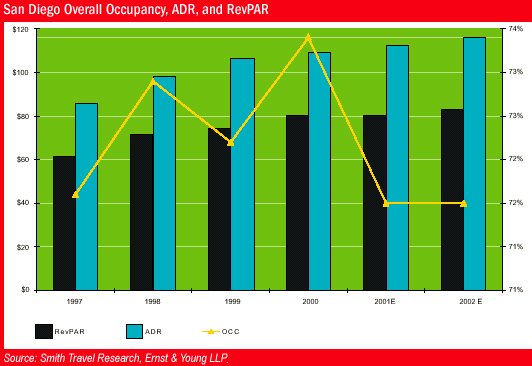

Los Angeles Lodging Forecast Orange County Lodging Forecast San Francisco Lodging Forecast San Diego Lodging Forecast Regional Markets |

| OVERVIEW

What a difference a year makes! After a record-breaking year in 2000, 2001 proved to be a very challenging year for California's economy. With the US economy officially entering a recession period in March 2001, the combination of a power crisis that cost the state $9 billion, the implosion of the dot-com sector, and the negative economic impact of the terrorist attacks have considerably squeezed the world's fifth largest economy. Preliminary results indicate that by the end of 2001 California's unemployment rate reached its highest level in five years and that the state's budget deficit is expected to balloon to $12.4 billion in 2002. Given the current monetary policy, which has lead to historic low short-term interest rates, significant reductions in energy prices, and gradual rebound in the stock market, a v-shape recovery is anticipated for the US economy in 2002. The pace of the national economic recovery will very much be tied to the recovery of the housing sector. Economists anticipate lower interest rates to increase the demand for purchase of new homes and an increase in refinancing activity as consumers opt to refinance their current mortgages due to lower financing terms alternatives. As the national economy begins to recover, California is anticipated to follow suit. The California economic recovery is anticipated to begin in Southern California with its concentration of defense contractors, entertainment, and biomedical companies and move to Northern California as the technology sector begins to rebound. California Lodging Overview �

Source: California Travel and Tourism Commission

|

|

|

|

|

|

|

|

|

| Beverly Crescent | 39 | Blue Hotel, LLC | Boutique Hotel Group | $5,000,000 | $128,205 | Jun |

| Four Points by Sheraton | 309 | KOR Realty Group | Jogi Nakno | $23,000,000 | $74,434 | Jun |

| Radisson Hotel | 196 | Kam Sang Company | Westmont Hospitality Group Inc. | $10,200,000 | $52,041 | Jun |

| Mandarin Oriental | 158 | Cornerstone Real Estate Advisers | L & L USA Inc. | $41,500,000 | $262,658 | Jun |

| La Costa Resort | 470 | KSL Recreation Group | Sports Shinko | $140,000,000 | $297,872 | Nov |

| US Grant Hotel | 285 | Wyndham Hotels | Historic Hotel

Partners |

$58,710,000 | $206,000 | Jun |

| Best Western

Victorian Inn |

68 | Cannery Row Co. | Coastal Hotel Group | $16,229,045 | $238,662 | Sep |

| Monterey Bay Inn | 47 | Cannery Row Co. | Coastal Hotel Group | $11,217,134 | $238,662 | Sep |

| Palma Mesa Resort Hotel | 133 | Chesapeake-Green | Triple Tree Corp. | $15,000,000 | $112,782 | Jun |

| Ritz-Carlton Rancho Mirage | 240 | Vail Resorts | Olympus Resorts

(RockResorts) |

$45,000,000 | $187,500 | Dec |

--

| Political/Economic/Legal Changes

Given the current economic uncertainty and plummeting consumer confidence, the political, economical, and legal environment will play a prominent role in the coming year in stimulating lodging demand. However, as tax revenues decline due to the economic slowdown, local authorities will have limited resources to assist struggling industries. Since the September events, government officials are projecting sales tax and hotel bed tax to decrease approximately four percent and nine percent respectively compared to budget. Unable to receive sufficient government subsidies, many hotels throughout the greater Los Angeles area began to implement an energy surcharge to deal with rising energy costs. Lockheed Martin's recent $200 billion contract with the US Department of Defense is anticipated to send a positive ripple effect throughout the Los Angeles aerospace industry and should help revive business travel. California's recent $5 million campaign to promote travel and tourism within the state, combined with the proposed $10- $15 million increase in marketing spending, should help lure weekend drive-in leisure travel to Los Angeles and its surrounding areas. The successful implementation of the current proposed Los Angeles airport

initiatives focused on making air-travel safer and easier to both the international

and domestic travelers, should help the city stimulate air-travel and tourism

to the greater Los-Angeles area. Additionally, if approved, Mayor Hahn's

proposed international airport construction in the former Air Force base

in El-Toro should help mitigate the growing congestion in Los Angeles airports.

The El-Toro airport is to be voted on

Introduction Given the economic downturn and the impact of recent events on the national lodging industry, 2001 proved to be a disappointing year for the Orange County lodging sector. With the completion of the $177 million Anaheim Convention Center renovation, the opening of Disney's new theme park and the completion of several lodging projects, Anaheim was poised for a banner 2001 performance year. However, in the aftermath of terrorist events and the ensuing retraction in lodging demand, Orange County's lodging performance was considerably weaker than expected. The performance of the Orange County lodging sector prior to September 11th (January - August) was very encouraging as room revenue was 12.3 percent higher than 2000 levels due largely in part to a 5.9 percent growth in demand to match an additional 5.2 percent in rooms inventory coming online. However, the Orange County lodging sector was severely impacted by the September events and lodging performance slipped to record lows in the months that followed. September, October, and November occupancy rates were lower than 2000 by 27.9 percent, 24.0 percent, and 10.2 percent respectively. Although Orange County's lodging performance remains weaker than anticipated, the long-term outlook for the sector remains positive given the area's proximity to large drive-in demand markets and Disney's theme park appeal to families. Major Demand Changes Orange County's renovated convention center, Disney's expansion efforts, and the completion of the $1.1 billion I-5 North Improvement Project should play a key role in inducing additional lodging demand to the area and enhance Orange County's lodging appeal as a multi-day destination. The renovated 1.6-million-square-foot Anaheim Convention center is helping position Orange County as an attractive meeting and convention destination in southern California and is helping attract drive-in demand from surrounding cities. Disney's much-anticipated 55-acre, $1.4 billion California Adventure theme park opened in February 2001 and is helping Orange County establish it self as a multi-day stay destination for families. However, the Southern California theme park industry has been challenged in recent months given lackluster attendance and pricing pressures from competitors. Although, attendance at the California Adventure theme park has been lower than expected for the majority of 2001, holiday attendance was significantly higher. Overall, attendance at Disneyland fell 11 percent to 12.4 million. In 2002 Orange County's ability to become a multi-day stay destination is anticipated to translate to additional room nights and therefore should greatly benefit the area's lodging sector. The completion of the I-5 North project is anticipated to further facilitate drive-in demand to the area and enhances Orange County's value proposition to prospective drive-in travelers. Major Supply Changes Orange County experienced a surge in hotel development activity in 2001.

The $250 million, 400-room St. Regis Resort in Dana Point opened in August.

In Irvine, a 174-room Residence Inn opened in July and in Garden Grove,

a 375 room Embassy Suites and a 371-room Marriott Suites opened in September.

The 251-room Doubletree Hotel, the first full-service hotel to be built

in Santa Ana in 10-years opened in December. In Anaheim, the 750-room Grand

Californian Hotel opened in January and Disney's Magic Inn & suites

opened as the 359-room Anabella Hotel in March. Additionally, as part of

a $37 million development project, the 264-room Holiday Inn and 163-room

Staybridge Suites opened in the summer. With the opening of the Grand Californian,

Anaheim now has seven of Orange County's largest hotels.

) |

| Political/Economic/Legal

Orange County's political and economical landscape is being challenged by the impact of the slowing economy and subsequent retraction in tourism spending. Given that Orange County's $6 billion to $8 billion tourism industry plays a vital role in generating the necessary tax receipts to sustain the city's development projects and ongoing maintenance efforts, city officials are currently having to deal with a substantial budget shortfall. The short-term consequence of the current budget deficit is that the local government may seek to cut costs by deferring needed maintenance, eliminating services, and even raising revenue by raising utility taxes. In the long-term, the current budget deficit is likely to impair Orange County's ability to initiate lodging-related projects and pursue those development opportunities that will enhance Orange County's tourism appeal. Orange County is anticipated to benefit from the growing air-traffic congestion in the Los Angeles area airports. Given the current trend to expand the capacity of alternative airports in the Los Angeles area, more passenger traffic is anticipated to overflow to the Orange County area airports as well. For example, if successful, the current initiative to develop the former El Toro Air Force base to an international airport could bring approximately 30 million passengers to the Orange County area. Introduction Faced with an economic slowdown, a downturn in the technology sector and softening in lodging demand, the city's number one industry experienced the most profound year-over-year decline in the state of California in 2001. 2000 was a banner year for the San Francisco economy and its tourism sector. Tourism revenues increased nearly nine percent over 1999. However, in 2001, tourism related declines had an immediate ripple effect on San Francisco's 34,000 room lodging sector. Prior to September, San Francisco's lodging industry was performing at approximately ten percent below 2000 levels, while post September, San Francisco's lodging market experienced performance declines above 40 percent compared to prior year. Given the continued downturn in business travel, increasing airline cutbacks and consumer flying concerns, as well as an economic recession, San Francisco's lodging market is anticipated to be further challenged in 2002. Major Demand Changes 2001 has challenged the city's lodging industry's ability to perform at prior year's levels. The highly skilled labor force and high quality infrastructure have been catalysts for the technology boom in the Bay Area. Given the recent downturn in the technology sector, office vacancy rates in the San Francisco area have soared from approximately four percent in 2000 to slightly above ten percent in 2001 with additional sublease lease available and not included in the vacancy rate. Consequently, office rent in downtown San Francisco are at approximately 50 percent below last year's levels, and is impacting the surrounding bay area cities such as San Jose and Oakland, who in the past enjoyed a resurgence in business demand due to lack of affordable space in the San Francisco area. Cisco Systems, citing changing economic conditions, has recently announced that it will indefinitely postpone the construction of its 6.6 million-square-foot world headquarters in the San Jose area. As the weak economy continues, the shrinking office market and the associated weakness in corporate travel spending are anticipated to further impair the recovery pace of the highly lucrative business demand segment. Airline cutbacks are also negatively impacting lodging demand in San Francisco and its surrounding cities. United Airlines, with a substantial San Francisco operation, recently reduced its flights schedule by 25 percent and announced 20,000 layoffs. With air-travel representing over 80 percent of San Francisco's visitors mode of transportation, recent airline cutbacks and ongoing consumer flying concerns are reducing lodging demand across all segments. Several development initiatives, however, are anticipated to contribute to San Francisco's unique value proposition and induce lodging demand. The Moscone Convention center's 750,000 square-foot expansion is anticipated to be completed by 2003 and generate approximately $240 million in additional convention-related revenues. University of California's Mission Bay biotech park development should

help San Francisco diversify its business mix and attract biotechnology

firms. The proposed $400 million Bloomingdale's development scheduled to

be completed in the summer of 2003 is anticipated to restore one of downtown

San Francisco's classic buildings, the old Emporium department store, into

a large retail-hotel-entertainment complex. In addition, the proposed $900

million transformation of downtown San Francisco's Transbay Terminal into

a mega residential, retail, and hotel development complex is currently

in its late planning stages and groundbreaking is anticipated as early

as 2003. Preliminary plans for a $300 million cruise ship terminal on San

Francisco's

US cities running to be the host for the 2012 summer Olympic games. Should San Francisco be selected in the fall of 2002, it is anticipated that a great deal of new development initiatives will be pursued. Major Supply Changes Several prominent hotel development projects, planned and constructed

during the technology boom, have been recently completed and others are

in the pipeline. The 375-room Clift Hotel, Ian Schrager's San Francisco

development opened in July. The 277-room Four Seasons San Francisco and

an 18-story, 450-room Courtyard by Marriott located adjacent to the Moscone

Convention Center opened in October. In downtown San Francisco the 362-room

Omni San Francisco is scheduled to open in January 2002 and the 269-room

St Regis Museum Tower is scheduled to open in 2003. Several other hotel

projects are slated for San Francisco's waterfront area, including the

Argonaut Hotel, a 268-room Kimpton Group property scheduled to open in

the fall of 2002 and a 200-room hotel between Mission and Steuart Street

scheduled to open in 2003. In the preliminary planning stages are two Stanford

Hotel Group hotel developments - a 410-room Marriott located at San Francisco's

waterfront area as well as a 600-room hotel near the airport. In San Jose,

a 506-room Marriott City Center is anticipated to open in January 2003,

and the Fairmont's additional 300-room tower is scheduled to open in January

2002.

|

.

| Political/Economic/Legal Changes

The recent downturn in tourism activity to the greater San Francisco area is anticipated to have a profound impact on the local economy. Last year tourism spending accounted for approximately $7.6 billion and is estimated to have sustained 82,000 jobs and contribute over $474 million to the city's budget. This year government officials are projecting a $100 million shortage in the city's budget due to the decline in the technology sector and the sustained weakness in tourism. Airline cutbacks are also a concern given that the area's three airports are estimated to directly and indirectly contribute more than $37 billion into the local economy and support approximately 1000,000 jobs. To stimulate tourism demand, Mayor Willie Brown announced several citywide tourism promotional programs and although no formal legislations are debated at this time, a government assistance package to the struggling local lodging industry is being considered. Introduction Due to San Diego's well-diversified economic base, recently expanded convention center, limited additions to supply, and proximity to major California markets, the local lodging market is well positioned and is anticipated to outperform other major lodging markets in the nation in 2002. Lodging demand is expected to remain strong in 2002 and is anticipated to benefit significantly from the recently completed and expanded convention center. The resort and leisure-oriented hotels are anticipated to further benefit from San Diego's drive-in market orientation. Overall lodging market fundamentals are further strengthened by a limited number of new supply additions. Major Demand Changes San Diego's economy is anticipated to benefit from the expansion efforts of several local companies in 2002. Idec Pharmaceuticals is expected to construct a new 362,000-square foot manufacturing and R&D plant in Oceanside that will ultimately employ 2,400 by 2003. Texas based EDS won a $10 billion contract with the U.S. Navy to build and maintain a high-speed Navy and Marine Corps Intranet. As a result, EDS is anticipated to establish a regional center in San Diego and employ 1,500 people. Raytheon, another defense contractor, is anticipated to open a new facility and increase it employment by 680. Technology firms Siemens AG, Nokia, Qtron, and Sun Microsystems have announced and are anticipated to increase their employment in the area. Additionally, Ford Motor Company recently relocated its alternative-fuel division from Detroit to San Diego, further enhancing the area's reputation as a technology leader. Hospitality specific, the $216 million expansion of the San Diego convention center was completed in September 2001. The expansion doubled the size of the facility to 1.8 million square feet, features state-of the-art equipment, and with this expansion, the city is expected to be further marketed as a first-tier convention city. Major Supply Changes Due to San Diego's strong economic and lodging market fundamentals, there is a high degree of interest in hotel development in the area, however, due to capital market constraints, supply additions remain negligible. Specifically, the downtown market, due the recent expansion of the convention center and future completion of the San Diego Padres Ballpark, is considered to be a highly desirable hotel development market. As a result, the Hyatt Regency commenced construction in July 2001 of its 33-story, 750-room addition to its existing 875-room hotel. The two towers will share a common lobby and new a 34,000-square feet exhibit hall and 30,000-square foot ballroom. The project is expected to be completed in 2003. Construction of the 512-room Westin at the Padres ballpark is expected to resume with the stadium construction and to be completed in the first quarter of 2004. The 261 room W Hotel is under construction and is anticipated to open the third quarter of 2003. Further, a 330-room Renaissance Hotel, a 450-room Inter-Continental, and three boutique hotels are in planning stages. The San Diego Unified Port District have embarked upon their master plan to develop the Campbell Ship Yard and Harbor Island, resulting in two additional hotel development opportunities comprising 1,700 rooms. Further, the California Coastal Commission approved a proposal to redevelop the former Naval Training Center on Point Lona. Redevelopment of the 279-acre site is anticipated to include two hotel sites with up to 1,000 rooms. With the passage of Proposition 1A, which allows Nevada-style gaming

on Indian tribal lands in California, several gaming-related initiatives

are in development. The Barona tribe is constructing the $225 million,

400-room Barona Bay Valley Ranch Resort and Casino. The new casino is expected

to open in late 2002/early 2003. The Rincon tribe has commenced construction

a $125 million, 200-room hotel and casino, which is anticipated to be managed

by Harrahs and is expected to open in late 2002.

|

0

| Political/Economic/Legal

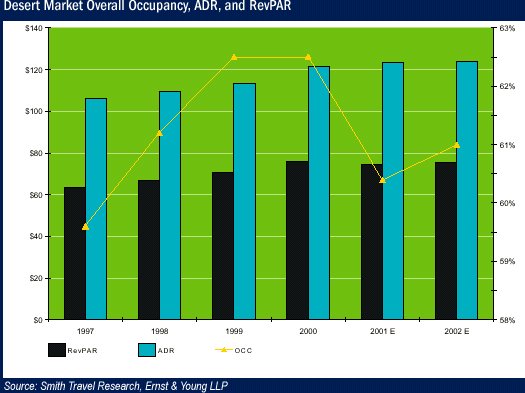

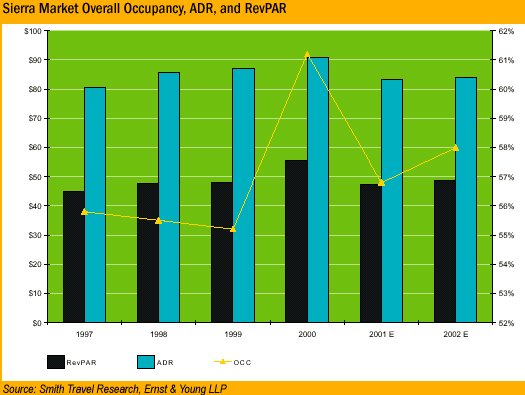

The San Diego market experienced significant increases in energy cost in 2001 due to deregulation. As a result, the California Public Utilities Commission implemented a stabilization plan for the San Diego area. The plan artificially stabilized energy cost by setting a fixed kilowatt tariff, however, consumers are accruing the differential between market and the fixed tariff. Due to the political considerations, it is not certain if the accrual will be passed along to the consumers directly or through tax and/or bonds measures. The construction of the San Diego Padres Stadium, a $267 million, 42,000-seat project, remains stalled due to numerous litigation and financial issues; however, construction is expected to resume in December 2001 and to be completed by the 2004 season. A proposed increase in the hotel tax from 10.5 to 13.5 percent was announced to subsidize the infrastructure improvements near the ballpark but is facing heavy opposition from the local hotel industry. Overview The diversity and beauty of California's geography is inherent in the uniqueness of its regional markets. California's three primary regional markets include the coastal, the desert, and the sierra markets The coastal market offers visitors numerous recreation activities and beautiful state parks. It represents approximately 7.8 percent of California's travel expenditures and contributes to approximately 9.4 percent of California's travel industry jobs. It is located between the San Francisco Bay area and Southern California, and includes Ventura, Santa Barbara, San Luis Obispo, Monterey and San Benito counties. The desert market offers a desert oasis escape with numerous high-end resorts located within a unique natural beauty setting. It represents approximately 5.3 percent of California's travel expenditures and contributes to approximately 6.6 percent of California's travel industry jobs. The desert market includes all of Imperial County, and the eastern portion of San Bernardino, Riverside, San Diego, Kern, and Inyo counties. The Sierra market offers a wide array of outdoor activities and is home to California's renown Yosemite park and several skiing destinations. It represents approximately 3.4 percent of California's total travel expenditures and contributes to approximately 4.6 percent of California's tourism industry jobs. The Sierra market includes all of Alpine, Mariposa and Mono counties, the eastern portions of Nevada, Placer, El Dorado, Amador, Calaveras, Tuolumne, Madera, Fresno, and Tulare counties, the northern portion of Inyo county, and northeastern Kern County. Introduction California's regional markets experienced a significant downturn in

visitation as the economy weakened and lodging demand retracted. The coastal

market experienced an approximate five percent decrease in RevPAR in 2001

compared to 2000. The mountain market, located within close proximity to

northern California's major markets, experienced an approximate 14.8 percent

decrease in RevPAR performance in 2001 compared to 2000. In contrast, the

desert market, located within close proximity to southern California's

major markets, decreased approximately 1.5 percent in 2001 compared to

2002. Looking ahead to 2002, California's regional markets are anticipated

to benefit form the resurgence in consumer preference for

Major Demand Changes Coastal Market The area's prominent demand generators include the Monetery Bay Aquarium, Pebble Beach, Monetery State Historic Park, Hearst Castle and the Channel Island National park. Given that the local government closely scrutinizes new development activity, new development in the area has been limited. For example, plans for a development of a 650-room resort located near San Simeon Point has been in negotiations with the California Coastal Commission for over three years and approval has not been issued. Desert Market New developments in the area include the $30 million industrial park near Thousand Palms that is anticipated to bring approximately 1,000 jobs to the Coachella Valley. In addition, the $50 million shopping and restaurant complex known as The River at Rancho Mirage opened in December and is anticipated to generate approximately $700,000 annually in sales tax to the city. The development includes 19 restaurants, numerous shopping stores, and a 12-screen Krikorian Theater planned in an open-air environment. On the gaming front, construction financed by Trump Hotels & Casino Resorts has begun on the $60 million expansion of Spotlight 29 Casino. The renovation is expected to be completed by Spring 2002. Sierra Market Within the Lake Tahoe area, more than $500 million in capital improvements are under way to put the area on par with other ski destinations such as Colorado and Utah as part of the city's Park Avenue Project. The Park Avenue Project is part of the city pedestrian-oriented project and will include the development of an ice rink, movie theaters, 35 shops and restaurants, and a parking garage. Completion of this phase is anticipated to be completed by late 2002. Recent improvements to the South Lake Tahoe skiing infrastructure include the completion of the $23 million Gondola that runs from the South Shore hotel area to near the top of the ski hill is enhancing the area's value proposition and convenience for skiers. Some development activity is underway in the Mammoth market area. The Mammoth Mountain Inn has built a new outdoor pool and spa and construction is underway for a new restaurant and bar at the top of Mammoth Mountain. Additionally, Mammoth and co-owner Intrawest have invested more than $75 million in mountain improvements over the past several years. In addition, Intrawest plans on spending $500 million over the next five to 10 years to create new lodging for 10,000 more guests. The projects are anticipated to include new base villages and retail centers. Major Supply Changes Coastal Market Given the area's tight California Coastal Commission control over new development, there has been minimal hotel development activity in the area. The 261-room Ritz- Carlton at Half Moon Bay opened in March. In Simi Valley, a 156-room Courtyard by Marriott is anticipated to open in December 2002. In Oxnard, a 164-room Hilton Garden Inn is under construction and is anticipated to open in January 2003. In the planning stages are plans for a 270-room hotel in Ojai and a 200-room hotel and casino in Santa Ynez. Plans for Fess Parker's 150-room Park Plaza Beachfront Hotel have been deferred indefinitely. Meanwhile, Ian Schrager's $35 million renovation of the Miramar resort, scheduled to be completed by late 2001 has been deferred and while Schrager remains committed to the project, no firm start dates have been specified. Desert Market A $9.5 million, 121-room Hilton Garden Inn is expected to open in May 2002 in Rancho Mirage. Plans are underway for a proposed $200 million hotel, golf course and business complex to be located in Palm Springs. Although construction has not started, the complex (The Midvalley Center) is anticipated to include a 500-room hotel as well as 200 vacation units, 18-hole golf course, and 500,000 square feet of business space. In addition, the 240-room Ritz-Carlton Rancho Mirage was sold by Olympus Real Estate Partners to Vail Resorts for approximately $45 million. The new owner renamed the property to Lodge at Rancho Mirage and decided not to build a controversial multi-million-dollar golf course in the Santa Rosa foothills adjacent to the property. Sierra Market Most new lodging supply activity as been in the Lake Tahoe area. The

Hyatt Regency Lake Tahoe Resort & Casino recently completed a $27 million

renovation. South of the lake, the Mountain Village at Kirkwood is nearing

the completion of an $18 million development that includes a plaza surrounded

by shops and restaurants as well as a condominium hotel and three new lodging

complexes. Marriott Vacation Club International recently acquired the development

rights in two lodging complexes under construction and began to develop

a 261-unit and a 199-unit timeshare resorts. The resorts are slated to

open in early 2002.

|

| Political/Economic/Legal

California's regional markets are facing significant budget shortfalls due to decreases in tourism volume and the consequent declines in tourism-related tax revenues. Given the regional markets' less diversified economic base, decline in tourism volume has a greater impact on the local regional economies compared with the larger California markets. Ventura County for example, anticipates a $20 million shortfall in the County's budget for 2002. Monterey government officials are anticipating a 13 percent or $2.5 million reduction in hotel tax revenues. Governor Davis is anticipated to announce a multi-million dollar reduction in county funding by the state in order to proactively respond to the state's anticipated 2002 $12.4 billion budget shortfall. These funding reductions are anticipated to further encumber the regional markets' ability to respond to the current economic weakness. Additionally, the upcoming state of California governor elections in November 2002 are likely to bring tourism and travel-related issues to the forefront of public debates. |

--

| The Ernst & Young 2002 California Lodging Forecast contains an

analysis of data compiled from many source inculding Smith Travel Research,

FW Dodge, and Lodging Econometrics. The contents of this forecast are for

reference only, not to be used as business advisement or to set standards

on policies or actions.

© 2002 Ernst & Young

|

###

|

ERNST & YOUNG Ernst & Young Real Estate Advisory Services Group M. Chase Burritt National Director, Hospitality Services (305) 358-4111 Los Angeles Office:

|

| Also See | 2002 National Lodging Forecast / Trends, Outlook, Market Segment Reports / Ernst & Young LLP / Feb 2002 |

| 2002 Florida Lodging Forecast / Major City Market Reports / Ernst & Young LLP / Feb 2002 | |

| 2002 Manhattan Lodging Forecast / Top 10 Thoughts for 2002 and Beyond / Ernst & Young LLP / Feb 2002 | |

| Impact of Recent Events on the California Lodging Environment / Ernst & Young / Oct 2001 | |

| Canadian Hotel Investment Report 2002 / Colliers International Hotels / Feb 2002 |